You can apply for Medicare Supplement health insurance plans in Alabama when you turn sixty-five and qualify for Medicare Parts A or B. If you become eligible for Medicare Parts A and B simultaneously, your coverage is subject to be converted to a single plan. Otherwise, you’ll be automatically enrolled in Medicare Parts A and B and receive notice that you’re eligible for enrollment. Medicare Supplement insurance companies offer different plans. Each company’s plans are not similar, but are comparable in many ways.

The type of Medicare coverage, you’ll receive will depend on your location, your age, family status, and the Medicare eligibility for Medicaid that you’ve determined. In Alabama, there are three Medicare options for individuals that are not yet eligible for Medicare Parts A and B: Assisted outpatient Medicare coverage, inpatient rehab Medicare coverage, and respite care Medicare coverage. The last option, respite care, is designed for people who need assistance with activities of daily living but do not qualify for hospital admission. (The term “refuge” is sometimes used to describe inpatient care, which is not covered under Medicare Supplement insurance.)

Medicare Supplement plans offer some features that are not available with other plans. For example, there are no deductibles for outpatient services. This means you’ll be responsible for your own out-patient care. Most Medigap plans in Alabama also have a daily maximum limit on the amount of times your beneficiaries can visit any one provider.

You can choose Medigap plans in Alabama from two different sets of plans – Parts A and Part B. Your choice will determine the amount of your premiums and the coverage details. There are also regional preference payments, if you live in a certain area and are allowed to participate in Medicare Advantage Plans. Medicare Advantage Plans are offered by almost all private companies.

When choosing a Medigap policy, keep in mind that it is not only a product you want to buy; it is also a major responsibility. Always consider the best Medicare supplement plan that meets your medical needs and finances. Medicare is a wonderful program that offers financial security to elderly citizens but can be confusing and frustrating when you don’t understand how the plans work. Medicare Part A and Part B must both be chosen carefully. Medicare does cover most inpatient hospital costs for you or your eligible family members, but each plan has its own specific rules and regulations, so it’s important to know which Medigap policies meet your medical needs.

Medicare Part A is the largest part of your insurance, but you may not be aware of how Medicare plays a part in your overall health insurance. Medicare Part A helps pay for your hospital care and the related services. Medicare Part A is a must as you reach the age of 65, but Part A supplements your Medicare benefits with health insurance coverage for you or a family member. Medicare Part B, which is sometimes referred to as Medicare Part D, is the Medicare supplement plan that helps cover other health care expenses you or your eligible family members may have. Medicare Part D will cover some of the out of pocket costs for doctor visits, medications and health conditions that Medicare won’t cover.

Stay true to the property and the neighborhood when you take on major renovations. If you live on a street of suburb ranch style homes, then putting in a colonial mansion is not going to get you the desired result you’re after. It will be out of place and not something anyone else will be willing to pay for later. One of the first things I consider is

Stay true to the property and the neighborhood when you take on major renovations. If you live on a street of suburb ranch style homes, then putting in a colonial mansion is not going to get you the desired result you’re after. It will be out of place and not something anyone else will be willing to pay for later. One of the first things I consider is  A Customer Relationship Management or CRM software system aims at improving the relationship with existing customers of a business. The tool is also important to find new customers as well as win back former customers to the particular business. These systems are extensively used in a majority of current business entities. Many businesses have spoken highly of the advantages of these tools. The tool will help collect, organize and manage customer information quite effectively. This article provides information on the benefits of using a CRM system for your business.

A Customer Relationship Management or CRM software system aims at improving the relationship with existing customers of a business. The tool is also important to find new customers as well as win back former customers to the particular business. These systems are extensively used in a majority of current business entities. Many businesses have spoken highly of the advantages of these tools. The tool will help collect, organize and manage customer information quite effectively. This article provides information on the benefits of using a CRM system for your business.

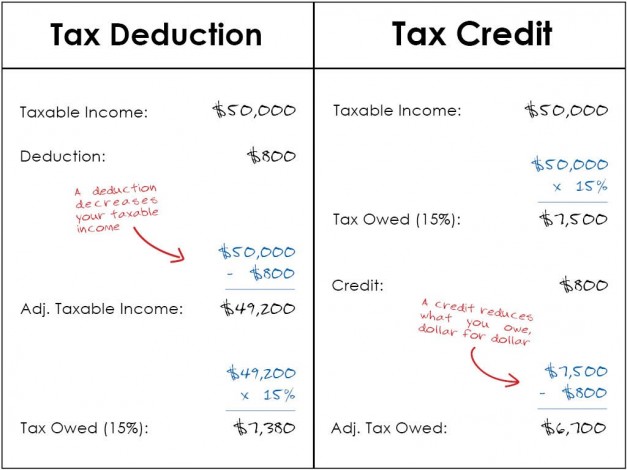

The old saying goes the devil is in the details. There is no truer place than where money is concerned. The reason is simple: whoever made the game and plays the game is probably going to win. While the Internal Revenue Service is not necessarily into “winning”, they do have some details that are worth knowing about

The old saying goes the devil is in the details. There is no truer place than where money is concerned. The reason is simple: whoever made the game and plays the game is probably going to win. While the Internal Revenue Service is not necessarily into “winning”, they do have some details that are worth knowing about

Overlooked

Overlooked

How

How